In recent times, with increasing awareness and generation gaps, the concept of a ‘family dentist’ is slowly fading away. Patients now want specialised treatment and they prefer all specialists under one roof. A few years ago, private practitioners considered their neighbourhood competitive clinics as danger. What practitioners consider dangerous now are big corporate giants, opening luxurious centres and dental chains all over the country. With a huge marketing machine and the ability to offer targeted incentives based on market research, corporate dentistry is very difficult to compete with. At the same time, it is emerging as a comfortable career option for dentists.

Here’s the current scenario of corporate dental chains in India

A. Apollo White Dental chain: founded in 2002 by Apollo Healthcare—has grown to over 70 dental clinics.

B. Narayana Health’s dental chain: founded in 2008—scaled to 30 clinics in six years, and was then sold to Axiss Dental in 2014.

C. Delhi-based Axiss Dental has just about 50 functioning clinics at present.

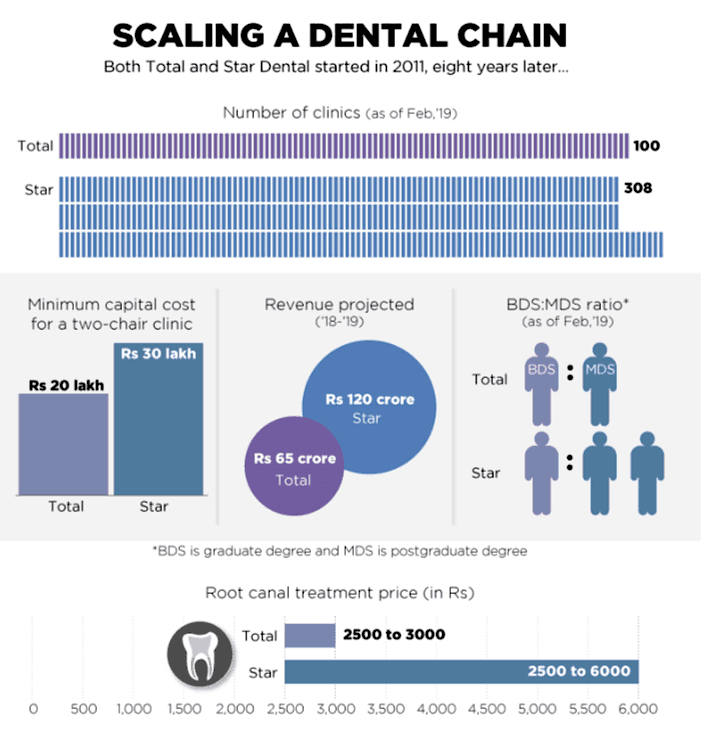

Two Indian dental chains were founded in 2011: Star Dental and Total Dental.

D. India’s largest dental chain presently: Star Dental, better known by its brand Clove Dental has 308 clinics spread across 26 cities: is now the 8th largest dental chain globally

E. Star’s biggest competitor is Total Dental, better known by its brand My dentist/ Sabka Dentist has 100 clinics across Mumbai, Pune, Ahmedabad, Surat, and Bangalore.

F. Founded in 2010, Gujarat-headquartered Fine Feather dental chain has grown from 3 to 22 clinics across Gujarat.

Clove and My/Sabka Dentist are clearly doing well than the others. Let us discuss these corporates in detail.

Some interesting tidbits of information about these two –

- Preventive care (consultation, cleaning and polishing) contributes 15% of My/Sabka Dentist’s overall revenue and 10% of Clove’s overall revenue.

- Apparently, 50-55% of Clove’s total expense is spent on materials and doctors.

- Till date, Clove Dental has raised a total of $60 million (Rs 425 crore).

- My/Sabka Dentist has raised around $14.8 million. (Rs 105 crore).

- Dr. Nitin Doshi (a dentist by profession & founder of National Dental in the US) is the 2nd largest investor in Clove-10 million $.

- Prominent investors in My/Sabka Dentist are private equity (PE) funds such as Asian Healthcare Fund and LGT Venture Philanthropy.

- Revenue in Financial Year 2017 :

Clove Dental : 28 cr

Sabka Dentist : 59 cr - Projected Revenue in Financial Year 2019 :

Clove Dental : 120 cr

Sabka Dentist : 65 cr

CORPORATE PRACTICE VS PRIVATE PRACTICE – A COMPARATIVE ANALYSIS

| CORPORATE PRACTICE | PRIVATE PRACTICE | |

| WORK INCLUSION | Dentistry | Dentistry plus renting/buying clinic space, interior décor, hiring and firing of employees, managing accounts and collections, patient and staff scheduling, training, sterilization, stocking of consumables and materials, lab communications, bill payments and maintenance. |

| AUTONOMY IN WORK | Strict protocol to be followed, limited only to the techniques and materials that the corporate team selects. | Full freedom in the theories, practices, materials and techniques to be followed. |

| MARKETING | Corporate’s responsibility Founded on conducted market research Controversial (in 2016, Maharashtra and Karnataka State Dental Council sent notices to My/Sabka Dentist for unethical advertisements) | Dentist’s responsibility Founded on word-of-mouth publicity Must be ethical by all means |

| WORK DURATION | Full time or part time | Usually full time to maximise profits |

| MONETARY INVESTMENT | Fully Corporate’s responsibility | Fully Dentist’s responsibility |

| INCOME | Fixed salary. Independent of OPD. Maybe additional incentives or share per case | Income is variable. Dependant on OPD. Entire treatment cost per case, excluding lab and material cost, belongs to dentist |

| GOALS | Targets fixed by the corporate to be achieved in the defined time frame to maximise profits | Depends on the drive, ambition and interest of the dentist. |

| RELOCATION | Easy. In nationwide groups, you may ask for a transfer to a new location if you decide to move. | Difficult. Entails selling of old clinic or re- establishing oneself again. |

Comments